Welcome to PMA Group

Interest Beyond The Numbers

Loan

Programs

Loan Programs

Your home isn't just a building—it's the foundation of your future. At PMA Group, we understand that every homeowner's journey is unique, which is why we offer personalized lending solutions designed to transform your aspirations into achievements.

Conventional Fixed Rate Mortgages

Take control of your financial future with a mortgage that never surprises you. Our fixed-rate mortgages deliver:

Guaranteed consistent payments for the life of your loan

Multiple term options (15, 20, or 30 years) to balance monthly costs with long-term savings

Competitive rates that help you build equity faster

No hidden fees or payment adjustments

Option to eliminate PMI once you reach 20% equity

FHA Mortgage Loans

Don't let a modest down payment or credit challenges keep you from owning your dream home. Our FHA loans open doors with:

Down payments as low as 3.5% of the purchase price

Flexible credit requirements that recognize your full financial picture

Competitive interest rates regardless of credit score

Option to include renovation costs in your loan

Gift funds accepted for down payment and closing costs

Ability to qualify with non-traditional credit history

VA Mortgage Loans

We're proud to serve those who've served our country. Our VA loans offer unmatched advantages:

100% financing with no down payment required

No private mortgage insurance (PMI)

Competitive interest rates that often beat conventional loans

Flexible credit requirements that understand military life

Lower closing costs with limits on permitted fees

Available for purchases, refinancing, and renovation

Lifetime benefit you can use multiple times

Home Equity Loans

Transform your home equity into opportunities with a fixed-rate second mortgage that provides:

Immediate access to funds in one lump sum

Fixed interest rates that may be tax-deductible*

Terms up to 30 years for lower monthly payments

No annual fees or prepayment penalties

Fast approval process with minimal paperwork

Funds for any purpose: renovations, education, debt consolidation, or major purchases

Buyers With Blemished Credit Histories

Turn the page on past financial challenges. Our flexible qualification criteria look beyond credit scores, considering your complete financial picture. With options for scores as low as 580, down payment assistance, and personalized guidance to improve your profile, we make homeownership achievable.

Jumbo Loans

Exceptional properties deserve exceptional financing. With competitive rates, flexible down payments starting at 5%, and multiple term options. Whether it's your primary residence, second home, or investment property, our jumbo solutions deliver premium financing without compromise.

Borrowers With Considerable Assets

Leverage your wealth strategically with sophisticated lending solutions. Qualify based on your liquid assets rather than traditional income, access portfolio-secured options, and benefit from flexible underwriting tailored to complex financial profiles. Includes dedicated support from our Premier Lending Team.

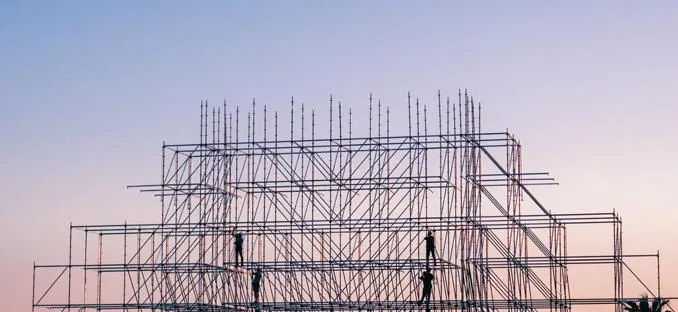

Construction Loans

Building your dream home from the ground up? Our construction loans are designed to provide the financing you need to turn your vision into reality. With flexible terms and a streamlined process, we work with you and your builders every step of the way to ensure your project stays on track and within budget.

Reverse Mortgage Loans

Access your home's equity during retirement without selling. For homeowners 62+, our reverse mortgages with no monthly payments required. Keep your home while gaining financial flexibility through regular disbursements, a line of credit, or lump sum payment. FHA-insured options available.

Real Estate Investors

Build your real estate portfolio with financing designed for investors. Access competitive rates on multi-unit properties, benefit from cash flow consideration in underwriting, and choose from various term options. Perfect for both experienced investors and those purchasing their first rental property.

Foreign Buyers

Invest in U.S. real estate with confidence. Our international lending expertise simplifies the process with higher LTV options, flexible currency and asset verification, and local market guidance. Available for primary homes, vacation properties, and investment purchases

Contact Info

Contact Info

Copyright ©2024 | NEXA Mortgage LLC

Company State License# AZMB - 0944059 | NMLS# 1660690